The stakeholders of today’s digital commerce and online shopping properties are currently afforded several significant growth opportunities, even in the face of today’s often uncertain times. That is, if they can successfully adapt to shifting online buying habits. The twin impacts of the pandemic and the resulting economic turbulence has indeed changed both consumer needs and perceptions.

These buyer shifts and the growth opportunity they represent are genuine and significant. For example, more consumers now shop online due to the pandemic according to United Nations Conference on Trade and Development data, with 3% overall growth globally from 2019 to 2020. This represents millions of new online buyers that can be readily tapped by those ready to meet their needs. Furthermore, as buying habits shift towards online, consumers may also be attracted to new digital experiences. This could quickly expand to buying experiences that weren’t considered online before, such as purchasing houses or using healthcare services.

The lesson: Those that adapted have tended to benefit most from these shifts. Yet, retailers have also encountered difficult economic times too, with sales having dipped measurably in recent months due to economic uncertainty. With a generally unclear sense of the near future, it’s certainly understandable that consumers may have interest in greater economic flexibility, such as more convenient payment options, from their preferred online shopping sites.

Solutions addressing economic objections directly in-channel have high appeal

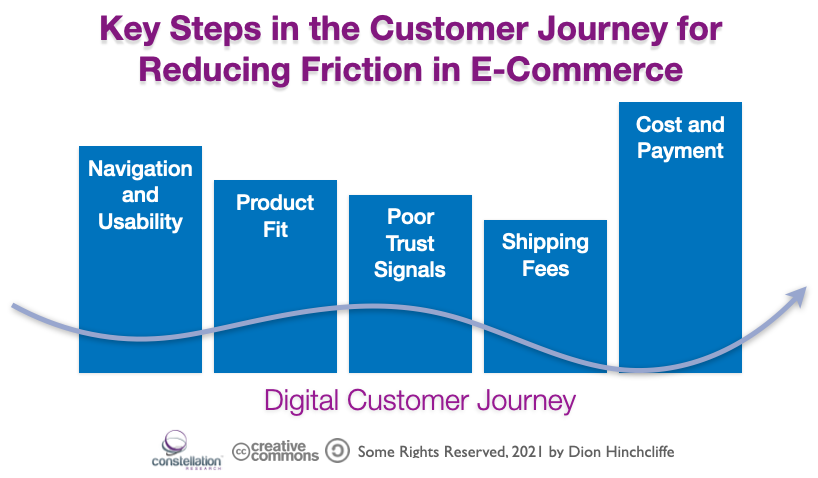

The friction in the average digital shopping experience remains significant however, especially during the checkout process. In fact, today's e-commerce cart abandonment rate has risen to just over 70%, a rate it has remained at for years. This is because available means of payment or ease-of-credit-qualification has become a leading reason for cart abandonment. The latest data suggests that e-commerce sites seeking to reduce shopping cart abandonment must focus on reducing the friction directly in the payment process itself, where the main resistance tends to take place. This means e-commerce sites seeking to reduce shopping cart abandonment must focus on reducing the friction directly in the payment process itself, where the main resistance tends to take place.

Reducing abandonment of the typical e-commerce buying session has three primary solutions that can help reduce friction and increase successful conversions:

- Easier navigation and user experience. Usability is intrinsic to the digital commerce experience, but it can be time-consuming and costly to implement and test.

- Just-in-time offers/coupons. Reducing the cost of the sales transaction is a key way to increase conversions, but negatively impacts margins.

- Flexible payment options. Making it easier for shoppers to use services such as buy now and pay later removes friction with little effort or risk on the part of the e-commerce site.

The Shortest Route to Offering Economic Flexibility To Online Consumers

While online storefronts have numerous options to address cart abandonment and e-commerce friction in general, an easier way is simply to use available offerings provided by existing payment partners. Because these partners are likely already integrated into the e-commerce site, they can be quickly activated and used to help reduce buying friction. This in turn offers more payment options to buyers with the least amount of time and effort and can directly help reduce cart abandonment.

Almost all e-commerce sites already have trusted payment partners that have flexible payment options ready to turn on. These almost always offer the shortest time to value for site owners and operators. In fact, in my current analysis, new payment options from trusted partners are the fastest route to conversion growth and higher customer lifetime value (CLV.) That isn’t all: In my research into modern e-commerce payment solutions, I have found that more flexible payment options don’t just address cart abandonment, it has other downstream benefits as well.

Figure 1: Overall cost creates the friction in the online buyer journey

The key downstream benefits of high economic flexibility in the customer jouney are:

- Customer retention/repurchasing. Shoppers who are given additional options to pay for their purchase tend to find the experience both helpful and rewarding and thus they tend to favor that site again says in-depth research.

- Higher customer lifetime value (CLV). Existing customers will convert more often and for larger amounts when they are given access to economic flexibility. This increases the key metric of CLV, which is the gold standard for customer value.

The key to rapid and successful rollout of shopping options offering economic flexibility is the use of trusted partners, who consumers may recognize and be comfortable with from the start.

A New Industry Example of Economic Flexibility: PayPal’s Buy Now Pay Later Solution

PayPal has recently entered in the market with a major offering that provides consumers with a way to buy now and pay later with a very simple and straightforward process. Pay in 4 from PayPal lets consumers split their payments for an e-commerce transaction into 4 equal payments, one every two weeks, starting the day they make their purchase. Pay in 4 is interest-free, has no impact on a consumer’s credit score and is fully backed by PayPal’s well-known brand.

Pay in 4 is prominently offered through the regular PayPal payment option in existing sites, making it extremely simple to use. One click makes it easy for an online shopper to understand the terms and another click to agree to them.

Figure 2: Pay in 4 payment options are typically included in the existing PayPal checkout experience

A leading adopter of Pay in 4 is the well-known food shopping service, Omaha Steaks. Omaha Steaks sought to offer their customers flexible payment options and evaluated Pay in 4 as a primary solution. As a key step in the evaluation, they chose to A/B test the economic flexibility solution to ensure the results were net positive.

During the test, Omaha Steaks displayed dynamic messaging about Pay in 4 to 65% of their customers on both product pages and in their shopping cart. Within a few months, the company saw an increase in both conversion and Average Order Value (AOV). As a result, they decided to roll out Pay in 4 to 100% of their customers in March 2021. Pay in 4 has since cited a 10.4% increase in AOV for those that use it in their messaging in the cart to customers.

The best part is the overall effort to enable Pay in 4 by most merchants is lower than the other ways of reducing friction that are listed above. Integrate easily and add dynamic Pay in 4 messaging with just a few lines of code.

Bottom line: New Innovative Payment Options Boost E-commerce Sales

E-commerce firms must ride industry and consumer trends successfully to continue to thrive. This means adapting to current market conditions as well as to specific customers’ needs to achieve sustainable growth.

Those who aim at directly reducing one of the largest sources of conversion friction — given it is one of the most significant sales performance advantages available to most merchants today — is an easier option for most e-commerce sites today.

Payment options such as PayPal Pay in 4 are leading examples of trusted payment options likely to drive growth in sales and customer acquisition/retention through offering shoppers more economic flexibility in a highly consumable way.

Learn more about PayPal’s buy now pay later solutions.

Additional Reading

A New Digital Experience Maturity Model for Improved Business Outcomes

How CXOs Can Attain Minimum Viable Digital Experience for Customers, Employees, and Partners

0 Commentaires