Big Idea: ESG Solutions Address the Impending ESG Imperative

Managing the Shift From Shareholder Capitalism to Stakeholder Capitalism

In 2015 all 193 United Nations (UN) member states adopted the 2030 Agenda for Sustainable Development—a framework that “provides a shared blueprint for peace and prosperity for people and the planet, now and into the future.” One milestone was a collection of 17 Sustainable Development Goals (SDGs) designed to fight and end all forms of poverty, inequality, and climate change. The intent was for all countries—from the poorest to the richest—to take action, protect the planet, and promote economic prosperity while ending poverty. Each country was expected to participate, with national frameworks and review at the global level. Although these SDGs are not legally binding, many activist investors have decided to incorporate the goals in their reporting requirements, and many organizations have begun efforts to shift corporate social responsibility (CSR) programs into ESG programs.

With the 193 UN member states all creating their own frameworks and thousands of asset managers and investors applying their own unique approach, the overall ESG efforts require a level of standards definition, data collection, data harmonization, and reporting. This, in turn, has created massive opportunities for technology providers and system integrators able to develop solutions to address these challenges.

An onslaught of massive regulations expected by governments around the world has added to this complexity, creating two massive markets—one for ESG metrics reporting and a bigger one for ESG enablement and solutions.

Constellation forecasts that the market size for ESG metrics reporting will be 1.425 billion by 2026, with a compound annual growth rate (CAGR) of 17.3%. Constellation expects that the ESG enablement and solutions market for the same period will reach well over $2.216 trillion. Constellation breaks down these software offerings and solutions into the three ESG buckets: environment, social, and governance.

Environment

Social

Governance

Twenty Business Trends Prioritized By Business Impact And Organizational Adoption

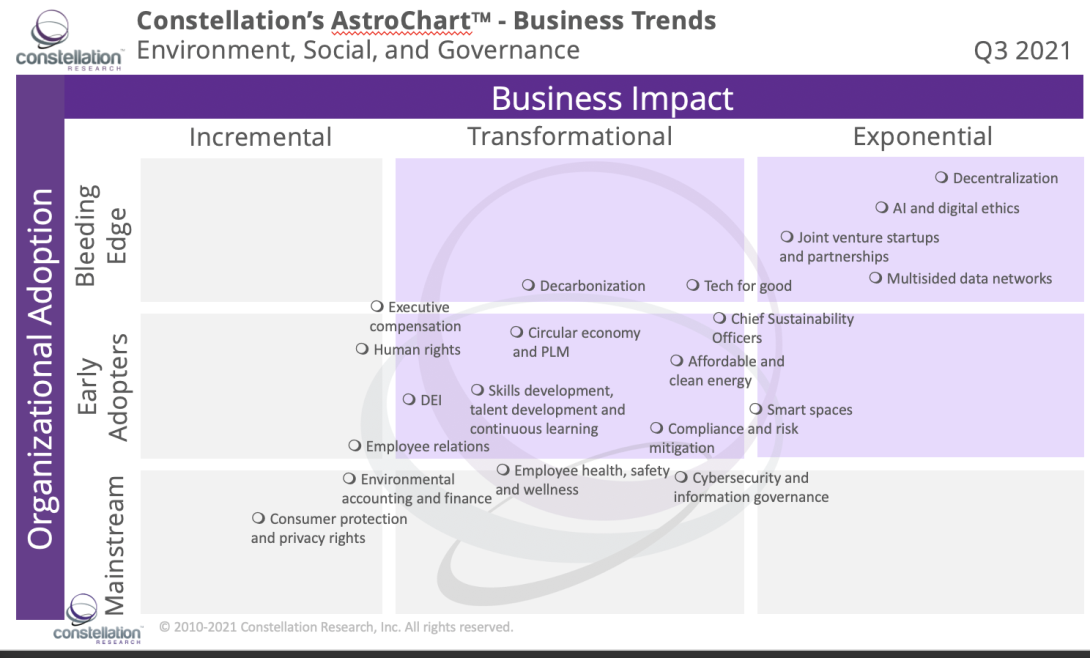

From extreme weather to privacy, cybersecurity threats to regulatory pressure, and demographic shifts to changing social norms, the ESG market has never been so dynamic or so volatile. Board-level members must navigate rising pressure from investors and asset managers along with the hodgepodge of complexity from a deluge of regulatory requirements. Consequently, new initiatives for achieving ESGs present an opportunity for improving regulatory compliance, operational efficiency, revenue growth, market differentiation, and impact on the organization’s brand.

The latest Constellation AstroChartä identifies 20 significant business trends and ranks them by business impact and organizational adoption (see Figure 1)

Figure 1. . Constellation’s AstroChart: Trends in ESGs Show Business Impact and Organizational Adoption

Source: Constellation Research, Inc.

The full report can be found on the Constellation Research website.

Your POV

Are you ready for the onslaught of ESG requirements? Will you develop your ESG strategy?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your AI, Digital Business transformation, ESG, and metaverse economy efforts. Here’s how we can assist:

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2021 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

0 Commentaires