If business leaders (and the world at large have) learned anything over the past two years, it’s that change is constant. In its mission to help companies prepare for change, financial performance management vendor Planful unveiled new predictive and collaborative capabilities at its May 23-25 Planful Perform 2022 event in Las Vegas.

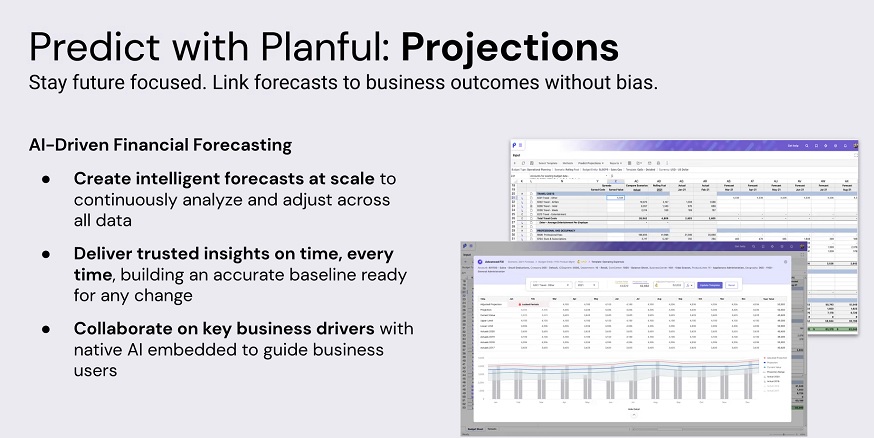

The biggest announcement at Perform was the general availability of Predict: Projections, the second of two predictive capabilities introduced by the software-as-a-service (SaaS) vendor over the last two years. The goal with Predict: Projections is to use artificial intelligence (AI) to accelerate and scale up financial forecasting. Importantly, it’s a computer-augmentation capability that “keeps a human in the loop,” pointed out Planful CEO Grant Halloran during his opening keynote.

“You don’t have to be scared of AI,” Halloran told the crowd of some 600 attendees. “Finance and accounting people don’t need to understand data science and they won’t need to hire a data scientist to use this feature. [In fact,] you don’t have to rely on the computer.”

Source: Planful

AI-generated Projections are offered in various user interfaces as guiding numbers, but users can adopt, adapt or ignore these figures as they see fit during budgeting and forecasting processes. Now generally available, the Projections feature has been beta-tested by more than a dozen early-access customers over the past six months, and Planful expects a crawl-walk-run adoption path.

A customer’s early use of Predict: Projections is likely to be on low-value accounts, said Andrew Chatfield, Chief Product Officer, with customers gradually using Projections to automate as they grow more comfortable and confident in the AI-generated forecasts. As Planful and its customers iterate, tune and generate more data for learning over the coming months and years, Projections are expected to reduce data touch points across the planning cycle by as much as 80%, said Justin Merritt, Planful’s Senior Director of Solutions Consulting. That will leave more time for financial leaders, planners and accountants to focus on the highest-value strategic questions, forecasts and analyses.

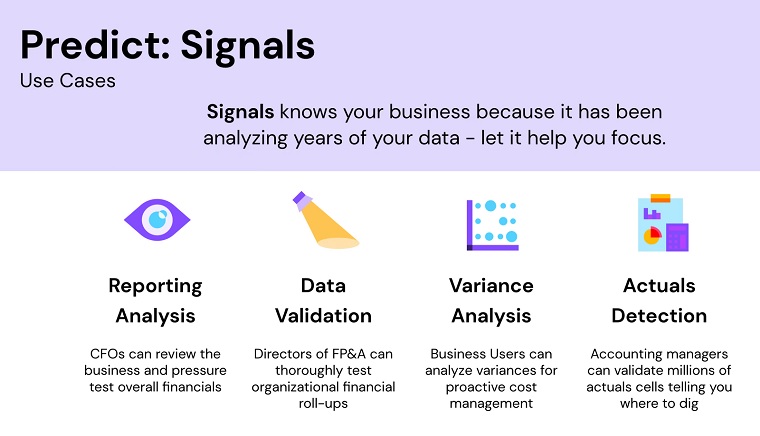

Source: Planful

Predict: Signals, introduced in 2021 and the first predictive feature that Planful delivered, went through a rewrite based on early customer feedback. Now in use by roughly 100 Planful customers -- about 10% of the customer base -- Signals is akin to a virtual fact checker that flags data points that are questionable. Here, too, it’s up to the human to heed or disregard a Signal, based on their knowledge of why exceptions might have occurred.

Customer adoption of Predict: Signals “took off” once it was exposed broadly through reports and at all levels of customer hierarchies, according to Rowan Tonkin, Planful’s Chief Marketing Officer. A Q3 update is expected to expose Predict: Signals even more broadly through Planful’s Spotlight interface for Microsoft 365.

Reaching More Users

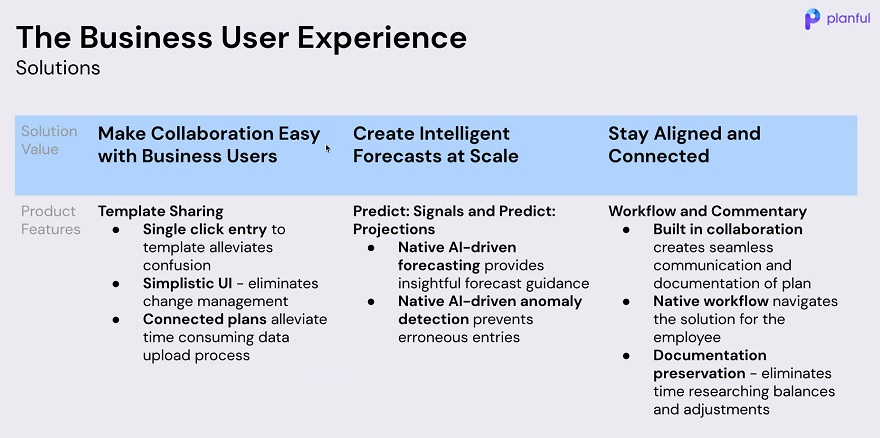

The goal of reaching a broader audience drove a second big announcement at Planful Perform: a new collaborative business user experience. This is the company’s second stab at bringing budget-owners and plan-contributors into financial processes, but these business-user types were slow to adopt an earlier “MyPlan” interface. Halloran reassured Perform attendees that the new business user experience delivers an “intuitive, zero-training” interaction.

The new interface is not a separate product; it’s simply how business users will “experience” Planful – through a templated, Excel-like web interface that is automatically populated with Planful content. The templates are customizable and easily administered, but, more importantly, the experience is seamless for the end user.

Source: Planful

“This will be a game changer,” said customer Gaylord Miller of the new approach. “I don’t have to export templates and users don’t have to navigate to the correct scenario; I just send them a link, they open the [Excel-like] interface, enter their data, and they are done.”

Miller, Senior Director of Financial Planning and Analysis at Imagen Dental Partners (Imagen), is a return customer for Planful, having used Host Analytics at a previous employer. He returned to the customer fold in 2021, about a year after the company rebranded as Planful. Miller says he vetted a number of competing financial performance management products – including Adaptive Planning, Anaplan and Onestream -- but he chose what he saw as a greatly improved Planful product.

“The product moved very far forward in the year or two that I was away,” Miller told me in a one-on-one conversation. “I never put a lot of operational data into Host Analytics because I would have worried about performance, but now I’m talking to customers that are loading terabytes of data into Planful.”

More data and operational detail gives customers the ability to do broader and deeper planning and analysis, including operational areas that directly determine financial performance. In Imagen’s case, Miller says he’s analyzing patient counts by dentist and by hygienist and total work hours to get a deeper understanding of productivity and profitability by practice. The more than 40 dental practices that are members of Imagen (and their more than 800 total users) are keenly interested in these and other financial and operational analyses. Many dentists and practice financial leaders are at ease interacting with Planful directly while others consume reports and are would-be candidates for the new business user experience.

Planful has been steadily improving on its scalability and performance over the last two years, according to CTO Sanjay Vyas. The latest advance is a new data fabric, code named Ivy, that has already been rolled out to Planful’s largest customers. Having opened offices in Toronto, London and Sydney during the pandemic, Planful is growing globally. That’s why it’s also beefing up support for complex entity structures, sub-consolidations, and reporting on intermediary currencies.

Halloran told Perform attendees that we’re heading into “a golden age for financial and accounting technology.” To me, another way to say it is that cloud-based platforms, rather than spreadsheets and email, are now the standard for all but laggard companies. A SaaS platform that’s on a monthly release cycle, as is Planful, is clearly built for change, and can gain new capabilities – like predictive and collaborative features -- in a matter of months. And whether it’s a pandemic or wars or supply chain disruptions, an agile, cloud-based platform can also help you roll with the punches and come out ahead of the game.

Related Reading:

SEC Moves Toward Mandatory Climate Reporting: Are You Prepared?

It’s Time to Prepare for the E in Environmental, Social, and Governance Initiatives

Modern Planning Platforms Drive Business Agility and Better Outcomes

0 Commentaires